Mortgages: The Key to your New Home

Everything you need to know to obtain a mortgage

You have been perusing NewHomeListingService™ leisurely, and to your surprise you’ve found the perfect place to call home!

A Condo downtown, perhaps, with stunning views overlooking the river; a gourmet kitchen with shiny stainless steel appliances and granite countertops; a chic bathroom with a corner soaker tub that will strike envy in all your friends, how could you pass up on this!

But, perhaps you don’t know anything about buying a new home, and maybe you have some questions about mortgages. We’ve all been there, so the Team at NHLS™ is here to give you the information you need to make one of the biggest decisions, not to mention one of the biggest investments, of your life.

First things first, what is a mortgage?

First things first, what is a mortgage?

The word Mortgage comes from Old French mortgage or mort gaige, meaning “dead pledge.” It is sort of an appropriate name. The French called this “conveyance of property as security for a loan or agreement” a mortgage because the deal dies either when the debt is paid, or when payment fails.

“A MORTGAGE is a loan of the money most people require to finance the purchase of their home,” Mortgage Consumer’s website reads.

Mortgages allow people who aren’t Oprah, or Bill Gates, the opportunity to buy property without paying the entire value up front.

First things first, the person borrowing the money is called the MORTGAGOR and the person lending the money is known as the MORTGAGEE.

There are all kinds of mortgages out there and one will better suit your needs and financial capability. There are open mortgages and closed mortgages; these define the term in which you have to pay back your mortgage. Fixed rate mortgages and variable mortgages on the other hand define the rate of interest you pay. It is extremely important to shop around, do lots of research and ask your brokers a lot of questions in order to find the perfect mortgage for you.

Term Type:

An Open Mortgage is one that gives you flexibility in your repayments without penalty. These usually have shorter repayment terms and can include some variable rate/longer terms, however the Mortgage rates on open mortgages are typically higher than on closed ones with similar terms.

Closed Mortgages are an agreement that cannot be prepaid, renegotiated or refinanced before its maturity. These are a good choice for buyers who are not looking to pay off the mortgage in a short amount of time. Closed Mortgages offer homeowners the ability to save on interest costs as they stay the same until maturity.

Interest Type:

Fixed Rate Mortgages are mortgages with a consistent interest rate. It’s locked in. This type of mortgage is good for buyers who need to know how much their monthly home payment will be to the very last cent. One of the disadvantages to this type of mortgage is that it can be harder for individuals with less-than-excellent credit to acquire an adjustable rate mortgage.

Variable Mortgages are different from fixed rate in the sense that the mortgage rates can be changed during the mortgage term, meaning interest rates can fluctuate. Mortgages are occasionally reviewed against the current market interest rate and either the size of the payment, or the length of the repayment term—also called an amortization period—is altered to reflect the changes in the current market interest rate. What’s the perk of this type of mortgage? Typically the interest rates are lower although there is no guarantee that this rate won’t change, so it’s a bit of a gamble.

STEP ONE: Are you financially prepared to buy?

Time to get Pre-Approved

Before you start shopping for a new home, or even considering speaking with a lender you must take a look at your personal finances, are you ready to buy?

The Canada Mortgage and Housing Corporation (CHMC) recommends that your monthly housing costs shouldn’t be any more than 32 per cent of your gross monthly income. This includes your monthly mortgage payment — the principal and interest — plus property taxes and utilities.

They also suggest that your entirely monthly debt load shouldn’t exceed 40 per cent of your gross monthly income. Meaning that all your debts, your home, your student loans, car payments, cell phone bills, credit cards, etc., shouldn’t be more than 40 per cent of what you make in a month.

If you are under these two monetary ratios than it may be time for you to start considering getting pre-approved for a mortgage that will get you started on your journey to buying a home.

The first step is to obtain a PRE-APPROVAL from a lender. A pre-approval will dictate your budget, so you won’t spend your time falling in love with homes that are out of your price range.

A pre-approval is offered to you by the lender — a bank, or another lender — and is a document that states how much they would be willing to lend you. Mortgage Consumer stated that the pre-approval process is usually guaranteed for a period of 90 days.

According to the CHMC, during your first visit with a lender, or a broker, you will need to bring along these documents that allow for a more accurate assessment:

- Personal ID such as a driver’s license

- Details on your job plus a letter from your employer confirming your salary

- Information on all of your bank accounts, loans and debts

- All your sources of income

- Proof of financial assets

- Source and amount of available down payment & deposit

- Proof of available funds to cover closing costs (between 1.5 per cent and 4 per cent of purchase price)

Need a CO-SIGNER? A co-signer is someone who signs the mortgage documents alongside you but has no intention of having any ownership over the home. This person’s signature on the documents is an agreement that states they will cover your debt if you miss a payment. What is the benefit of having a co-signer? The lender may be able to increase the limit of your loan, which expands your budget!

The Lowdown on Down Payments

The mortgagor will be required to make available a DOWN PAYMENT, which is a lump sum — a minimum of 5 per cent in Canada — that you put towards the cost of the new home. “The amount of your mortgage is determined by the purchase price of the home less the amount of your down payment,” Mortgage Consumer reads.

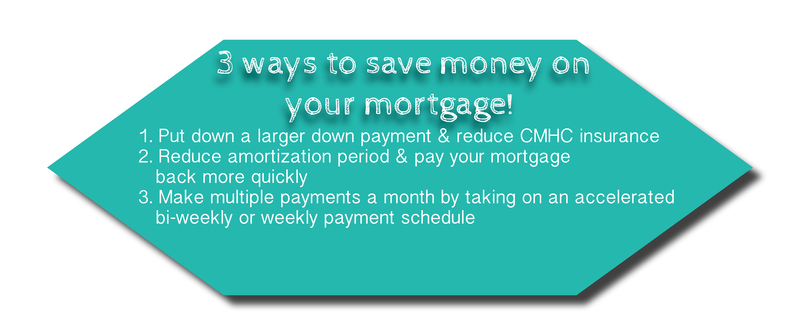

The size of the down payment affects these 3 things:

- The cost of the home you can afford

- The size of your monthly payments and your mortgage

- The amount of CMHC Insurance that you have to pay

The trick to a lower mortgage is a higher down payment. The more you pay up front the less you have to borrow.

Most people looking to purchase their home want to put a minimum of 20 per cent down payment because at that point the mortgage default insurance (or CMHC Insurance) is no longer required. This insurance helps to protect the lender in case the borrower defaults on the mortgage.

STEP TWO: Finding the home!

Time to browse those listings

Now it’s time for the fun part! You’ve been pre-approved and it’s time to start shopping! Find the perfect condo or single family home to make your own. NewHomeListingService™ has over 3,500 newly built homes listed and counting, why not start there?

Here are a few questions to consider while shopping:

- What is the neighbourhood and its amenities like? Is it near good schools, close to shopping, low crime rate, near to transit and public services such as fire departments, easy commute to work?

- Should you look at a House, Condo, or Townhouse?

- Is the home big enough? How many bedrooms do you need? Is your family going to grow in the next couple of years? Will this space be affordable to heat? Will there be too much to clean?

- Do you need to invest a lot of time and money into it to make it livable? Is it a fixer-upper, or is it a new home?

- How many years do you intend on staying here? This question may be influenced by the size of the home.

- Is this particular home a good investment? What is the resale value like on similar homes in the community, similar?

- Most importantly: do you love it!? You have to come home everyday, and if it doesn’t make you feel great you won’t enjoy it.

If you’ve answered these questions then you may be ready to make your purchase!

STEP THREE: Purchasing the home

The Transaction

You’ve found the house of your dreams and you are ready for the next step: writing the offer!

When you purchase a new home you will write an offer to the show home salesperson or the REALTOR® who can each help guide you through the process. If you are unsure about the offer writing process, consider seeking legal advice. You may need them again when you are finalizing your purchase and the title transfer. The offer typically includes conditions you need to meet before making it a firm sale. Financial approval is definitely the most important condition.

The offer you have written and agreed to is then submitted to your mortgage broker who passes it along for processing. If it is under 20% down payment, they submit it to the mortgage insurance provider they utilize, such as CMHC (Canadian Mortgage and Housing Corporation) or Genworth, which determines approval for the property.

If the down payment is 20% or over there is no insurance to pay for, so to be sure the property is worth what you are paying for it, the lender requests a property appraisal from a Registered Property Appraiser. The assessment is submitted to the lender, not to you, and that helps the lender determine if they will approve your mortgage for that particular house.

You may have had other conditions like needing to obtain a property inspection, but once having completed all of those conditions the deal is firm and you have successfully purchased the home — congratulations!!!

The Closing Date is the big day! This is the day in which your housing purchase/refinance takes place. Your lender will forward the funds with the transfer of home-ownership and then the keys are passed onto the buyer!

It is during this time that it is important to seek legal advice to ensure that the transfer and title registrations are finalized properly.

Once that’s all done, it’s time to celebrate. Welcome home.

STEP FOUR: The repayment process

Now it’s time to start paying back your mortgage

There are several options to customize your repayment in order to best suit your needs.

First things first, you have to decide how long it will take you to pay this back and how many amortization periods you will need. An Amortization Period refers to the length of time you choose to pay back your mortgage. Typically these are around 25, 30 & 35 amortization periods, but these can be as short as 15 years.

The longer the amortization period, the smaller the payments are each month, however the longer the amortization period, the higher the interest will be to pay off over the lifetime of the mortgage. Making extra lump sum payments when the money is available can reduce interest.

The Payment Schedule can vary as well. You can pay once a month, twice a month, each week, or bi-weekly. You can save on your interest costs by increasing your monthly payments.

When you select an accelerated weekly or bi-weekly payment option, you are essentially making the equivalent of one additional monthly payment each year, which will help you pay off your mortgage faster. This is called an accelerated payment schedule.

An example of accelerated payments

If I wanted to purchase a home for $150,000 with a Fixed-Rate Mortgage at 5.5% interest, then my monthly payments would look a little something like this:

You can try your own calculations on our mortgage calculator from ratehub.ca

|

Payment |

Amount |

Amortization (Years) |

Amortization Interest Cost |

|

Monthly |

$915.59 |

25.0 |

$124,675.23 |

|

Semi-monthly |

$457.80 |

25.0 |

$124,013.33 |

|

Bi-weekly |

$422.58 |

24.8 |

$122,919.67 |

|

Weekly |

$211.29 |

24.8 |

$122,620.77 |

|

Accelerated bi-weekly |

$457.80 |

21.2 |

$102,289.95 |

|

Accelerated weekly |

$228.90 |

21.2 |

$102,044.46 |

This chart shows that by choosing an accelerated bi-weekly or weekly payment schedule would save you approximately 3.5 years on your mortgage, plus more than $22,000.

Two Hundred dollars may seem a bit unreasonable but when you think about eating lunch out at a restaurant each day and having that morning Pumpkin Spice Latté, that adds up to about half of that $228 payment.

Mortgages are something that just about every person has to acquire because we all need a place to put our head after a hard day’s work. But it does wonder for your equity and your credit score. Not to mention, you’ll join the ranks of Homeowner!

Although owning a home is one of the biggest, and sometimes scariest, investments you can make, you are truly doing yourself a favour. Instead of paying your landlord rent, you are paying yourself.

Amortization Period: the amount of time it will take you to pay back your mortgage in full. Typically, in Canada, amortization periods come in 25, 30 and 35-year periods, but these can be as short as 15 years. More years it takes to pay off lowers your monthly payments but increases the amount of interest you pay.

Amortization Period: the amount of time it will take you to pay back your mortgage in full. Typically, in Canada, amortization periods come in 25, 30 and 35-year periods, but these can be as short as 15 years. More years it takes to pay off lowers your monthly payments but increases the amount of interest you pay.